|

Former Lawyer victims of Dewey LeBoeuf may only escape severe financial harm

________________________________________________________________________________________

The recent history of Dewey & LeBoeuf shows a firm with ethical, legal, and financial issues which we believe put in question their survival as a going concern.

Beginning in December of 2011 and extending into January of 2012, BankruptcyMisconduct received a number of what we'll call "indirect indications" about Dewey & LeBoeuf. We dug a little further and found some significant issues. We began this ongoing analysis, and a prognosis, about the firm in early February 2012. (As of late February we see that apparently so has Above The Law , and then a number of other sites). Please continue with your helpful insights, comments, and suggestions. We hope to have an online forum in place later this year. We will keep you updated as the D&L story develops. Bookmark This Page & stay in the loop!

Dewey & LeBoeuf - Preliminary Analysis:

Financial & Going Concern Viability

While this opinion concerns the law firm Dewey & LeBoeuf, we believe that this analysis may form a useful template for capturing valuation and risk vectors not commonly considered by general corporate finance theory methodologies. BankruptcyMisconduct will identify categories of risk affecting the law firm's viability within the confines of a predominantly subjective review. Of particular import is what we term Intra Firm Risk. This internal risk is explained below as rising from divergent circumstances regarding culpability, career maturity, whistle-blowing incentive, and the assumed willingness of junior partners to fund retirees and favored partners with guaranteed draws. We believe that the private nature of the firm and its financing, the dramatic negative connotations associated with identified matters that have been publicly disclosed, as well as speculative factors we believe have ripened, all contribute to the relevance and usefulness of this qualitative discussion.

A complete model of the various forces affecting the viability of the firm, particularly with respect to the dynamics of differing self interests among it members, would require insight from the fields of game theory, risk adjusted discounted cash flow analysis, probabilistic optimization, option theory, and behavioral psychology. Given space and time limitations for this site, we invite more knowledgeable readers to acquaint themselves with such fields of study to enable themselves to develop their own informed opinions. We believe that giving appropriate consideration to the various self interested perspective of all parties affecting the operations and stability of the firm is necessary for a non-trivial understanding and prognosis.

I. Background

BankruptcyMisconduct had our attention first drawn to the firm solely because of their agglomeration with the entire bankruptcy team of Bruce Bennett, the former named and founding partner of Hennigan, Bennett & Dorman. Bennett and his bankruptcy lawyer team already had been featured in a number of pages and free downloads on this site.

We learned just one year ago in February of 2011, of the Bennett team move to Dewey LeBoeuf. At the time, we were unashamedly skeptical about the wisdom of this reorganization and provided our own analysis of the risks, competing personnel interests, and professional repercussions to the affected lawyers involved, as well as to their current and prospective clients. However, our awareness and understanding of the circumstance of Dewey & LeBoeuf was practically nil. Now, one year later in February of 2012, it seems only proper that we analyze this entity anew.

II. A Smattering of Factoids

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

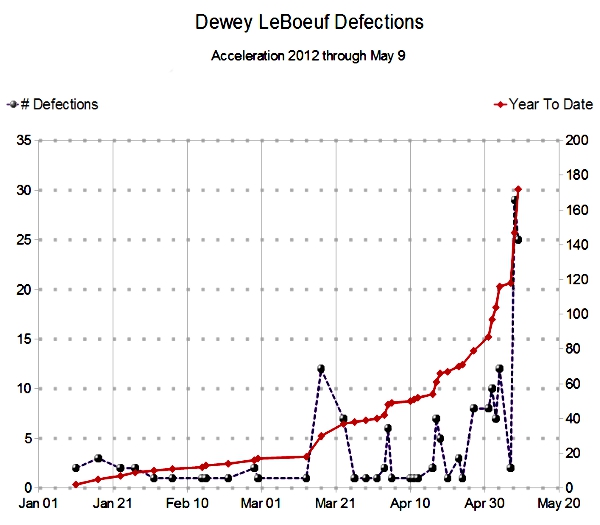

Partner Losses Above 100 Year To Date May 7

-

-

-

-

-

-

-

-

-

-

-

-

Recent Partner Defections: M. Stoddard Banking Head, H. Adler, G. Apfel, G. Berne, G. Boss,

E. Blanchard, J. Pari, P. Gray Dubai , C. Exberger, C. Moore, G. Warnke, J. Pari, L. Ransom

-

-

-

-

-

-

-

-

-

-

- "Teetering on the Edge Of Collapse" New York Magazine April 24

- Double Tax Defections F. Gander, H. Wein TheLawyer April 24

- Debt to Banks under-reported - more than double at $70M WallStreetJounal April 24

- "staff members were told that clients do not pay the firm in a timely manner,

therefore the vendors are not going to be paid in a timely manner" AboveTheLaw April 24

- Another 1 Bites The Dust: Greg Smith to Allen & Overy AmLawDaily April 23

Total partners losses in 2012 to date is at least 70

- Dewey LeBoeuf cutoff by FedEx, Car Service, Document Storage AboveTheLaw April 21

How can a law firm operate after getting cut off by essential services?

How long did the firm think they could stiff important vendors?

- Dewey & LeBoeuf Said to Be Considering Bankruptcy Bloomberg April 20

- Dewey LeBoeuf retains Bankruptcy Counsel Thomson Reuters April 20

- BankruptcyMisconduct Hacked! April 20

- Dewey Partner says publicly "There’s a chance we might turn it around" April 19

- Déjà Vu Dewey needs refi from Citibank - who pulled plug on Howrey April 18

- Viability Debunked: update re Banks, Partners, Clients & Sitrick April 17

- Another One Bites The Dust: DC based Michael Klein defects AmLawDaily April 17

- Eight Senior Partners Defect: Utilities Group and Energy / Capital Markets Pair

Bud Ellis, M. Fitzpatrick, S. Friend, S. Loeshelle, P. O’Brien; C. Hood, A. Terrel; W. Primps TheLawyer.com April 17

- Manic Monday London & Dubai foursome defect LegalWeek.com April 16

Camille Abousleiman, Louise Roman Bernstein, Gavin Watson, Chris Sioufi to Dechert

- Dewey & LeBoeuf denies that it has hired bankruptcy counsel April 16

- Dishing the Debt Dewey & LeBoeuf Merger "Railroaded Through" TheLawyer April 16

- Manic Monday Private Equity duo Davis & Van Praagh Depart TheLawyer.com April 16

- Sitrick's Folly: Law Firm Implosion Expert: Dewey LeBoeuf spin is "absurd" April 12

- Another Partner Defects: David Smith - total of 52 so far in '12 AMLawDaily April 12

- "Dewey & LeBoeuf Struggling to Stay Afloat" JDJournal April 12

- Survival Questioned, hopes pinned on a few Partners Thomson Reuters April 11

- Richard B. Spitzer a corporate finance partner leaves Wall Street Journal .com April 11

- More Partner Defections: Rock, Paran Wall Street Journal online April 10

- Editorial - demise follows confidence loss Banks, Partners, Clients April 10

- Another One Bites The Dust structured-finance head Stephen Rooney to Mayer Brown April 6

- John Altorelli - one feature of affinity to the polished and humane Caesar April 6

Former partner's candid commentary praising Steven Davis - questions the new "Gang Of Four"

(Props to Thomas De Quincey)

- Dewey LeBoeuf planning "Brass Handcuffs" hoping to stem defections April 5

New plan would delay profit distributions 2 years, could extend bankruptcy claw back window to 4 years

- Like an obstinate child, Dewey still claims Partner Exodus is planned, looks forward to More Apr 4

- Reports of Bitter Infighting among Dewey LeBoeuf pre-merger legacies April 5

- Yet another 6 partners abandon "decimation of Dewey’s insurance practice" April 4

James R. Woods, co-chair insurance, John M. Nonna, Larry P. Schiffer, Eridania Perez, Peter A. Ivanick, Lawrence M. Sung

- "Entire mergers and acquisitions group takes a hike" 4 partners April 3

- Capital Sufficiency and Survival “prisoner’s dilemma” April 3

- As recently reported by LegalWeek: Dewey LeBoeuf concedes that loan covenants are at issue - Despite FortuneCNN interview on March 23 with Chairman Steven H. Davis in which he addressed internet discussions that suggested the firm was "at risk of violating some covenants" with the incontrovertibly bold "Those rumors are utterly and completely bogus". How about that...

- Anti Trust Partner Eamon O’Kelly rumored to be of Irish descent, abandons Dewey LeBoeuf March 29

- Gang Of Four takes power at the firm WSJ.com March 27

- Eric Reifschneider famous for $2.5 billion win for Qualcomm, abandons Dewey LeBoeuf

- Six More Leave (Monday), including Pruitt, Shoss, Mace, Dwyer, LegalWeek.com March 26 2012

- Head of Houston Office - Sean Gorman high stakes litigator departs WSJ.com March 23

- Six More Partners Defect (Friday) despite management's special meeting Wed asking partners to stay WSJ.com March 23

- Dewey LeBoeuf planning to stiff partners on previously promised profit sharing CNN Money March 22

- Dewey Chairman Davis attempts to calm worried partners at special meeting Law360.com March 21

- Dewey LeBoeuf concedes revenue exaggeration of $155 Million dollars ABA Journal March 22

- Reports of Intra Firm Conflict between partners from legacy Dewey Ballantine vs. LeBoeuf Lamb AboveTheLaw March 21

- Public Doubts Raised about Continuing Existence of Dewey LeBoeuf

- Another 12 Lawyers abandon Dewey LeBoeuf including partners Dye, Groll, Rachofsky, Schwolsky March 17 2012 (Bloomberg) Happy St. Patrick's Day

The defection "guts Dewey's transactional and regulatory insurance group, one of the firm's key practice areas"

- $3 Billion Dollar lawsuit against the firm - General American / John M. Huff

A copy of this lawsuit can be obtained free from the BankruptcyMisconduct section on Dewey LeBoeuf. There are scorching accusations of willful and deliberate acts by the firm Dewey LeBoeuf undertaken to enrich themselves and third-party conflicted clients (such conflicts allegedly withheld from their victim) at the expense of their victimized client.

- Questionable Association & Risk Exposure

BankruptcyMisconduct has detailed its opinion on the Bruce Bennett bankruptcy team's move to Dewey & LeBoeuf here. Beyond our belief that the prior analysis continues to be valid, and concepts therein applicable to the analysis at hand; We believe that the business decision for the agglomeration by senior persons of Dewey LeBoeuf is a reflection of their evaluation of their own firm's risk profile, prospects, and reputation.

- Unconventional Financial Backing

In April of 2010, Dewey LeBoeuf refinanced its bank debt with a $125 million private placement of bond debt. This is "a rare action by a U.S. law firm" as reported Bloomberg News and associated negatives are "fees, which can exceed $5 million, and loan covenants that may require the borrowers to maintain certain levels of cash flow or profitability"

- Apparent Operational Retrenchment

There are a number of acts by the firm consistent with cash flow difficulties, or at least operational retrenchment.

- Bonus payments to associate lawyers due April 1 withheld / delayed March 21, 2012

- Dewey Have Comment on Recent Developments? Yes — Firm Is Cutting 5 to 6 Percent of Personnel Above the Law Mar 2, 2012

- Clifford Chance Hires 2 Dewey & LeBoeuf Deal Makers NY Times DealBook Jan 11, 2012

- Law firm vacation, or is that salary cut? Law.com Jan 14, 2011

- Dewey LeBoeuf's Chickens (Associates) Coming Home to Roost The Careerist May 21, 2010

- Dewey's City employment group jumps ship to Morgan Lewis The Lawyer March 4, 2010

- Dewey Revenue Down 11.3% makes 10 percent reduction in partner ranks lawyrs.net March 10, 2010

- Dewey & LeBoeuf ‘pauses’ summer program in three US offices lawyrs.net July 28, 2010

- A difficult year at Dewey LegalWeek.com April 9, 2010

- Dewey Cuts 30 Administrative Staff Above the Law March 9, 2010

- Dewey, Shearman Lay Off About 160 Support Staff The National Law Journal March 4, 2009

- Liability Arriving with New Partners

Perhaps a new twist on the business of BigLaw, when a law firm liquidates it might sue other law firms for business lost when former members bring former clients. (see Jewel v. Boxer) Reportedly, a number of former lawyers of Heller Ehrman joined Dewey LeBoeuf just prior to its collapse, and this legal theory may result in a forced allocation of some revenues from Dewey LeBoeuf to the estate of the former Heller Ehrman. Beyond the financial loss from forced revenue sharing, this raises the questions of when liabilities can leap the corporate divide along with partners who switch firms. (Read about successor liability and induced breach of fiduciary duty here). We believe that crime defeats the corporate veil, and that RICO forfeiture provisions trace the flow of all derivative funds which may have flowed in any part originating with predicate acts. We don't have any case law to present with respect to law firms, but our lay understanding is that when the Feds milk an organized crime entity, corporate identities are ignored and a substantive consolidation of assets is made just prior to forfeiture. We make no prediction with respect to Dewey LeBoeuf, but if criminal repercussions follow from General American, SONICblue, or subsequent allegations followed the RICO paradigm, viability may likely be the least of the concerns affecting Partners at the firm. In particular:

- Law Firm Implosion expert Jerome Kowalski writes: "Breach of fiduciary duty claims are also regularly made against those in management who defect prior to dissolution, with these new partners’ law firms made co-defendants for inducing such breaches." In light of SONICblue, and perhaps other cases, the desertion by named partner Bruce Bennett from the defunct Hennigan, Bennett & Dorman may add to Dewey LeBoeuf's financial problems.

- Unconventional Explicit Member Inequalities

Beyond the traditional Partner / Associate economic dynamic, the firm has recently undertaken official policies which may exacerbate non-beneficial rivalry among its membership.

- Multiple reporting sources claim the firm is withholding approx $100 Million in partner distributions owing to certain partners, while making distributions to others.

- Intra Firm Discrimination Since At Least 2009 Dramatic salary reductions below starting lawyers for 20% of partners, Davis acknowledges 40% hold back of normal partners and 100% payment to certain unnamed 'top performers'.

- WARN Act liability increases downside and pressures unsecured creditors. Excised staff and lawyers may be entitled to additional compensation to the extent terminations are considered concurrent and within Warn Act protections for employees.

- Alleged Labor Violations attempting illicit cost savings

Dewey LeBoeuf was accused of violating the Fair Labor Standards Act in a putative class action case brought by a computer systems operator in New York. BankruptcyMisconduct is researching this item.

....More Coming Soon!

III. Analysis

Central to our analysis and prognosis, BankruptcyMisconduct believes that the sum total risk to the continued existence of the Dewey LeBoeuf firm exceeds the sum total of the risks of current lawsuits, future lawsuits, and short to medium term cash flow impairment due to stigma affects. We begin with a very brief theoretic foundation for readers who may not have undertaken formal corporate finance studies, followed by our analysis segmented by type of risk.

Cash Flow Theory 101: Cash flow is the life blood of an enterprise. Stop the cash flow, and you likely are suspending, or ending, the existence of the enterprise. Of course, these truisms are focusing on positive cash flow, or money flowing into the entity. The obverse of positive cash flow is negative cash flow - money flowing out of an enterprise. Just as it sounds, negative cash flow is a bad thing for an enterprise. A related concept is working capital - the amount of money available to an enterprise to fund its operations. Working capital is a reflection of the wealth of an enterprise and the net sum of its short term cash flow. Cash flow problems tend to lead to working capital problems, and this can lead to a liquidity crisis if capital or credit sources are reduced or withdrawn.

What causes negative cash flow to a law firm? Usually, the only negative cash flow to a law firm are its expenses, and the capital withdrawal demands of its owners or partners. We'll elaborate on these expenses which ordinarily comprise the total negative cash flow of a law firm. We all understand that firms have expenses such as rent, phone charges, promotion, electronic research, and salaries for the " little people". More interesting is the cash flow to "partners" - essentially all those persons who are not "little people". Regardless of the technical details of the formation of a law firm, for the purposes of analyzing negative cash flow to these persons, we can model a law firm as a partnership. The vast majority of the cash flow distributed to people working for a law firm are distributed like profit sharing to the partners of a partnership. And the more important you are as a partner, the bigger your share of the loot. Obviously, the $3 Billion dollar lawsuit represents both a potential game changing negative cash flow, as well as a harbinger of potential consequences to the firm resulting from its decisions, culture, and membership. As described, this is a qualitative analysis. We welcome contributions of data which would enable a broader analysis which could include quantitative evaluation and factor testing, such as is found in traditional evaluation of distressed and potentially distressed firms. Information such as EBIT, EBITDA, currents assets, lending covenants, as well as specified financial targets required to prevent technical default are common requisites in traditional default analysis.

A) Litigation Risk - The Zone of Insolvency (Note to self: elaborate on the obvious)

While we seem to be the only voice considering the economic hit that the $3 Billion dollar General American lawsuit may bring, we believe that a " reality check" is warranted as to this implicit best case assumption implied by the deafening silence on the matter. Consider that the Goldman Sachs defendants agreed to settle their liability to GAMHC for an amount just over $100 Million dollars. Also consider that the Morgan Stanley defendants settled their liability to GAMHC for about the same $100 Million dollar figure. Our understanding is that the misconduct alleged against Goldman Sachs and Morgan Stanley, though intertwined with the conduct of Dewey LeBoeuf, was much less responsible for General American's downfall, and furthermore was not inflamed by the extraordinary context of attorney / client abuse incorporating undisclosed conflict of interest. We believe that GAMHC stands to recover considerably more from D&L, at least $100 Million if settled and up to $3 Billion if litigated - excluding litigation costs. But even if D&L is able to settle this lawsuit for only $100 Million dollars, in light of the firm's admitted financial problems, we believe that an additional burden of $100 Million or more far exceeds the firms current liquidity and may be the last straw which erodes the presumption of the firm's solvency. Given the widely known context of Dewey LeBoeuf's current financial troubles, we find it difficult to imagine a context in which John M. Huff, or any successor charged with fiduciary responsibility for GAMHC, would risk his own neck by accepting any sort of deferred settlement payment. Even more incredible is the thought that a third party lender would step up to fund such an obligation. Then again, perhaps GAMHC is contented with the moneys from Goldman & Morgan and will release D&L to move unfettered on to their next victim client.

B) Operational Risk

Consider the following rhetorical question:

"Who wants to burden his fiduciary duty, and expose himself to personal risk, by agreeing to retain counsel with a clouded past?"

We believe the above question illustrates a negative growth problem for the firm. Prior to the resolution of any litigation, a firm impaired by accusations of wrongdoing (not immediately dismissed or resolved in its favor) suffers diminished standing and reputation. While BankruptcyMisconduct won't attempt a quantitative influence to Dewey LeBoeuf's cash flow and profitability, we can only interpret the spreading knowledge of the General American Mutual allegations as negative. We don't perceive that time will have significant mitigating affects on this stigma. Furthermore, we believe that even if the problem litigation were to be resolved completely in its favor, the firm will suffer lingering stigma. A year ago, our narrow review introduced Stigma effects on P&L via reduced revenue and increased insurance expenses. We should extend our evaluation of stigma effects to include negative affects on the availability of capital, both internally reserved and externally sourced. Just as a potential client, or an insurance company, may avoid doing business with a law firm suffering stigma - we believe that investors will generally avoid, or expect to be compensated for, doing business with a law firm suffering stigma. In combination with perceived risk as effected by stigma, restrictive covenants incorporated in the private placement loan documents may place the firm in technical default when operational results are reduced. We can not speculate on the extent to which the negotiations of the private placement bond offering incorporated the disclosure of the litigation matters, or were affected by stigma. We do assume that stigma will reduce the availability of capital, and / or raise the expense thereof.

A possible factor on firm viability may result from the unconventional financial backing via the private placement. We believe that any external debt can have an effect of leaving the issuer "short an option". The scant publicly disclosed details of this financing include that the bond issue has a staggered maturity as short as 3 years. Working Capital is often funded on a revolving basis, and much has been written on the dangers of a reliance on external funding of working capital via debt. Lending institutions are not generally obligated to extend financing, but banks may sometimes sensitive to the needs of an enterprise. This is not as strong a case with a bond issue. There is virtually no obligation to purchase another issue of bonds, or to extend maturities. Thus we have two elements of Dewey & LeBoeuf's financing which may leave them short the option. One is the existence of financial covenants which might be violated in difficult economic times, or due to revenue reductions from stigma. The other is the pre-established maturities of the bond offering begin in the short term. Generally, an equity based funding of the working capital requirements for an enterprise is consistent with viability and lower risk, while debt based funding is consistent with reduced viability / higher risk. This is particularly true when debt based funding has shorter maturities.

The interplay between these working capital decisions and differing self-interest among the firms membership is covered in the section "Internal Risk".

- Pension Liability Time Bomb

A number of articles have been written describing significant unfunded pension liabilities for Dewey LeBoeuf, and there are aspects of their pension problems which may negatively affect viability, even in the near term. The problem of unfunded retirement benefits is sadly not uncommon. It was reported in 2007 that the attempted merger between Dewey Ballantine (precursor to Dewey LeBoeuf) and Orrick Herrington & Sutcliffe imploded due to this pension "time bomb". Apparently, Dewey was the only side of the merger with unfunded pension obligations. The failed merger negotiations reportedly had anticipated a $41 Million dollar portion of this deficit, but in the time before closing of the merger, the departure of 11 lawyers from Dewey raised this amount to $53 Million dollars causing the merger to collapse. Apparently, As Dewey partners with vested pensions leave the firm, their pension must still be honored. We don't know how many of the "original" 1,100 lawyers of Dewey LeBoeuf have these pension parachutes in place, but this sort of construction represents a serious lurking concern even for a firm not having cash flow problems. We were surprised to learn that some law firms had not converted to the defined contribution bandwagon along with the rest of private enterprise in America. No matter what the details are, unfunded pension liabilities are like a bucket with a hole in it. And you need to fill the bucket with your revenues which can't be used to pay other expenses or profit sharing. Obviously, the pension problems reduced firm viability. We have additional comment in our section below newly retitled as: Pension Entitlement Gradient.

When BankruptcyMisconduct began this Viability analysis on Dewey & LeBoeuf in mid February 2012, we were the only public voice questioning the firm's going concern risk. Since our ongoing analysis began, there has been a crescendo of public comment on the firm, its management, and its financial circumstance. ( note to self: consider adding in links to external web pages) These other commentators seem consistently negative on the prospects for the firm. Expanding our analysis of the " public mind" even further to include comments in web page articles, as well as posted in forums, we perceive a recurring theme holding that the existence of this broad based negative press represents " the begining of the end" for Dewey LeBoeuf.

On Wall Street, they say that you are only as good as your last trade. In the legal business, you just can't expect a corporate manager to risk her neck by recommending the retention of your high priced law firm for an important matter when she knows that if the representation is harmed by the law firm's dissolution, Monday morning quaterbacking will jeopardize her own career. There are just too many other law firms to choose from.

Client Perception is the essential justification for very high billing rates which firm like Dewey LeBoeuf have been able to demand. But who will want to pay top dollar rates for services which may be interrupted without warning?

After reading the other opinions on the internet, we concur. The public revelations of the admitted financial problems at Dewey LeBoeuf, by itself, may be enough to have triggered a loss of confidence by current and potential clients. Such would result in further reductions in revenues and inflame an inescapable downward spiral. Ironically to BankruptcyMisconduct, the demise of Dewey LeBoeuf could be triggered simply by doubts in their financial stability, as opposed to what we believe are more serious doubts as to their ethical and criminal misconduct.

C) Internal Risk - Organizational Dynamics vis a vis Asymetric Compensation & Control Structures

Perhaps the greatest single factor influencing the viability of the firm Dewey LeBoeuf derives from the varied and arguably opposed financial participation, career status, and individual risk exposures among its widely disparate membership. There exists a fundamental agency conflict between the members who control decisions of the firm, and all other members of the firm. While the existence of such conflict is normal, the extraordinary nature of the facts and circumstances affecting the firm raises the stakes. Decisions could be made to benefit the decision makers to the detriment of other members, or the firm itself.

- Culpability Gradient

Perhaps the most obvious difference in incentive among the members of the firm is related to each member's relative participation in alleged misconduct. Closely related to explicit participation in any potential misconduct is the implicit participation by persons that could be deemed to be in a supervisory/managerial role. BankruptcyMisconduct does not have the expertise or desire to make decisive statements as to the trigger mechanisms which would ensnare managerial persons into their own ethical, civil, or criminal problems merely as a result of their supervisory role of others. We can point out some laws and rules which we think may be relevant.

The Lawyers Code of Professional Responsibility governs New York lawyers (similar rules affect lawyers in other states) and it specifically prohibits "dishonesty, fraud, deceit, or misrepresentation" by its rule DR 1-102 Misconduct. Moreover, lawyers are required to report violations of this rule by another lawyer in accordance with DR 1-103 Disclosure of Information to Authorities. We believe that the debatable attorney client privilege exception to DR 1-103 is nullified when a) the misconduct is done by a supervised employee and b) the misconduct includes a crime. Also relevant is the Criminal Code Title 18 U.S.C. § 2 Principals, § 3 Accessory after the fact. , § 4 Misprision of felony.

A "guilty" party may only care about getting one or two more years of profit sharing, and have little incentive to consider the long term viability of the firm. If the personal "downside" for decision maker is large enough, he may perceive his best outcome to be the pursuit of "all or nothing" strategies. Stated simplistically, when there is nothing left to lose a gambler goes "All In". Thus, if persons holding control of an organization are subject to culpability risk personally, they may advocate decisions which are sub-optimal for non culpable players. Suffice it to say that we believe the "Culpability Dynamic" has the affect of complicating an already difficult set of circumstances and may only contribute to Intra-Firm Conflict.

- Career Maturity Gradient

Just as a bond, a bottle of wine, or a bushel of fruit have a maturity, so too does a personal legal career. There is time spent as a junior associate, a time spent trying to earn a partnership, and hopefully for these participants a time when partnership status has been achieved and a share of firm wide profits is received. (Read our insight on the Decline of Western Neo-Legal Oligopoly Power on the bottom half of the Kasowitz Fee Padding page.) There are vastly differing circumstances affecting members of such a firm based upon their own personal maturity along the lawyer career path. Lawyers sell time, and we each have but a few moments on this earth. We believe that range of Career Maturity results in different incentives for members of the firm.

It may seem counter-intuitive for members of a law firm to prefer a course which does not have the continued existence of the firm as its priority. Those persons for whom the continued existence of the firm is paramount would prefer that the allocation of cash flow to "partners" a/k/a "big people" is minimized whilst the allocation towards working capital and reserve for contingencies is maximized. Directly counter to this interest are persons for whom the maximization of cash flow to themselves is preferred over the deference of funds for working capital and reserves. While the latter may also desire the continued existence of the firm, the magnitude of current cash flows may overwhelm the discounted cash flows that could be attributed to their participation with the firm as a going concern.

A partner nearing retirement has no incentive to reduce his profit sharing, and instead would prefer to maximize distributions. This incentive is arguably directly in opposition to prudent planning designed to ensure firm viability. We believe that the common Career Maturity Gradient may be exacerbated by the extraordinary circumstances to cause Intra-Firm Conflict.

- Pension Entitlement Gradient

As discussed above in the Operational Risk section, BankruptcyMisconduct recently learned that Dewey LeBoeuf is saddled with substantial liabilities for unfunded pensions. Beyond the financial problems this present the firm, it represents another vector which divides incentive among the membership.

Some portion of legacy Dewey partners hold vested pension benefits. According to a New York based legal consultant, when these members leave "the firm still owes the benefits but has lost some of the revenues that they were counting on to meet those obligations."

Reportedly, the legacy pension accrual scheme has been frozen. Thus, current and future workers will not be receiving these lavish pension entitlements while they are still obligated to divert a portion of profits, and thus cash flow, towards paying these legacy obligations. We need not spend much time explaining how firm instability can be inflamed by such a unilateral wealth transfer mechanism. There is potentially an even more destabilizing influence. This split between those receiving a pension and those funding pension payments complicates game decision among the members, and enhances Intra-Firm Conflict just as it reduces firm Viability.

Legacy Dewey members who hold vested pension benefits may perceive that they should defect Dewey LeBoeuf as soon as possible to maximize their personal financial and retirement circumstances. These members may be at advanced career stages where a lateral, or founding, move needs to be taken now. Staying at Dewey LeBoeuf is the equivalent of having all eggs in one basket. Leaving the firm may provide continuing current income, a vested pension plan, the cessation of profit sharing/reducing contributions to that plan, and avoidance of career disruption in the event of Dewey LeBoeuf's dissolution - all at arguably no cost in terms of changing their vested pension plan viability. To the extent that these potentially departing members are at the tops of their careers, rainmakers, or experience sharing leaders the firm is doubly hurt. Financially for the pension liability surge, and fundamentally for the loss of expertise. In an atmosphere of heavy departures during financial distress, such departures may only accelerate the partnership defects as described below "The Snowball Effect".

- Informant Inclination Gradient

The criminal aspect intertwined in some of Dewey LeBoeuf's challenges yields another gradient which may differentiate incentive and "game decision outcome" among the firm's membership. Game theory predicts opportunities and pitfalls for the members along the lines of the classic example known as The Prisoner's Dilemma. While we make no statement as to whether criminal or ethical regulatory investigations have or will be commenced, the opportunity for a member to greatly reduce his or her risk necessarily results in higher risk for the remaining members who fail to act first. Stresses induced by radical differences in culpability, career maturity, compensation, and control all contribute to each member's personal Uhland Decision with respect to becoming a whistle-blower or informant.

Beyond the safe harbor protections from criminal or state bar consequences, there exists additional incentive for such a decision. A Whistleblower is generally provided explicit and implicit protection when they inform about their own organization. Benefits may affect career and personal financial circumstances. Ironically, a member may raise his job security by whistle-blowing. A whistle blowing memo is near impossible for a former employer to refute as the root cause in the minds of a jury in a wrongful termination / constructive termination suit. Furthermore, the first to the "deal window" may reap additional benefits of lucrative speaking and writing engagements. See how the opportunistic accountant made out after WorldCom. Then again, easy money from speaking about business ethics may not be of interest to many such as the "Asperger Endowed" or immutably loyal foot soldiers.

Interestingly, a game decision to become a whistleblower may be rational to a broad spectrum of the membership. Members from the least seniority to the highest seniority, and the least culpable to the most culpable could deem themselves ripe. The most culpable have the most incentive to earn immunity, and to frame the course of any official investigation. The genuinely most loyal members may see past the myopic dissonance of extremist professional courtesy - and realize that the earliest bright line identification of culprits unworthy of membership is the only rational choice for Dewey LeBoeuf's ultimate survival. We wouldn't know where to begin a quantitative or predictive measure of this dynamic, so we won't. We believe that the extraordinary disclosed circumstances elevate this internal risk multiplier to a credible consideration. Point is, much less than 1% of the firm's 1,000 plus membership is required to moot the question of whether the firm is "in play" - promising a wannabe prosecutor an easy notch against a target with practically nil public sympathy.

- Static Segmentation Presumption Error

Senior management at Dewey LeBoeuf have apparently made an error in their presumption of a static opportunities profile among their members. When analyzing a profit motivated enterprise composed of persons such as a law firm, it is important to remember that each member remains an individual game decision participant. Thus, profit maximization strategies that would normally be employed by a rational employer holding monopolist power are not available to this enterprise. If the firm did genuinely exert monopolistic power over the negotiable wage/profit sharing decisions of all of its members, then a static model of the (presumed unique) sub-segment of "rainmakers" could lead to rational, and stable, asymmetries in control and compensation. But this oversimplification of individual production, mobility, and acceptance can inflame intra-firm conflict, particularly when the differentials are deemed significant or arbitrary.

Failing to understand (or even construct) a relevant model of a multi-player game space is demonstrated in the failures of governmental entities to predict behavior as seen in the Laffer Curve, Winner's Curse, and in most governmental attempts at societal engineering. Similarly, entities run by committees, lawyers, or individuals with eccentric ego influence are susceptible to prediction errors when they have failed to account for dynamic multi-party equilibriums. The ignominious days of the micro-managed New York Yankees under George Steinbrenner's hyper influence illustrates the problem of trying to over-arbitrage talent, and the team's success once liberated from "helicopter management" is indisputable. Long story short, the more BankruptcyMisconduct learns of the extraordinary attempts to apply focused favoritism to certain members within the Dewey & LeBoeuf law firm, the more we believe that teamwork, joint sacrifice, camaraderie, and tradition are being sacrificed to mismanagement. You can only get so much blood from a stone. Squeezing them indefinitely is not only a vain attempt, but looks stupid, is bad for your fingers, and can start to annoy your loyal rockers.

There are large transaction costs buried in each loss of a firm member, especially partners, and with each reassignment of a member. This type of cost is also experienced by the client, assuming the client does not follow the departing lawyer. Just as there are "rainmakers", there are many necessary contributors such as "grinders", "client managers", "nurturers", and "crunch-time loyalists". While large law firms may genuinely hold neo-monopolist power over the associate sub market, we believe that short term focus on rainmaker class of partners can unravel the fabric which supports such an entity whose productive assets are not in machinery, real property, or capital but so focused in talent. The potential for disillusionment among the partners may also "trickle down" to the associate ranks. The sacrifices made by junior BigLaw lawyers in their personal lives are done with a believed rational expectation of a chance at partnership status. As this achievement is diminished, so too is incentive.

D) Existential Risk

We believe that the Existential Risk for Dewey LeBoeuf exceeds the combined effects of Litigation & Stigma Risks. To be sure, these two obvious risks are severe for the firm and should be cause of concern for management in and of themselves. However, the simple truth affecting this type of firm (see the Snowball Effect a/k/a the Domino Effect) is that once uncertainty rises above some difficult to pinpoint level, analogous to the concept of "critical mass" in Physics, defections can create a self reinforcing momentum towards implosion. The collapse of a legal firm after suffering this type of distress is not uncommon.

BankruptcyMisconduct recognizes the substantial, and earlier, public comment and analysis on this topic as it applies generally towards law firms. It seems as though management of the firm itself recognizes their predicament as evident in reports of a special meeting wherein partners were asked to consider staying. Traditionally, a partnership position in a law firm is coveted and members perceive their continued association to be in their personal best interest.

- Lower Transaction Costs (Stigma) for Defecting Partners During Firm Distress

Senior management's admission of problems provides blanket cover for members seeking employment elsewhere. There is no awkward explanation needed when finding a lateral position when your current firm's management has made the public admissions that Dewey LeBoeuf already has made.

- Entity Structure & Market Environment Conduce "The Snowball Effect"

Large "Big Law" firms are more susceptible to instability due to employee turnover than most other firms, due to the focused contribution of specialized, non-fungible, labor. For such a firm, as each employee is lost, the value and stability of the firm is reduced by a greater proportional amount. The critical points of inflection coincide with 1) the point when the sum of the expected revenues attributable to the remaining employees exceed the fixed costs (including base & guaranteed salaries) of the enterprise and 2) when the actual cash flows realized by the remaining employees are exceeded by the immediate cash flow needs. These needs include ERISA payments, rents, base & guaranteed salaries, fees, expenses, and so forth.

- Best Opportunities For Earliest Defectors -"Rush for Lifeboats"

A contributing factor to the "Snowball" effect is that for each individual member seeking employment elsewhere "the early bird gets the (best) worm". Though finding new employment while leaving a distressed firm can be a much quicker process than a lateral move from a stable firm, there are undeniable advantages to those leaving first, particularly in a difficult economy. At the extreme, there simply may not be enough open positions at hiring firms to accommodate all of the members desiring to leave, or finding themselves unemployed in the event of further cust cutting or firm dissolution.

- Lateral Move Decision Most Likely for Best Producers -"Self Selection Bias"

Members for whom a move makes most sense include department heads, group leaders, rain makers, and most productive workers. These members would most easily find a job with a lateral move. Obviously, these are exactly the same members whose loss would most seriously hurt the old firm. The loss of such valuable members, likely to be well respected internally, acts as a signal to other members, and inflames to the Snowball Effect (a/k/a the Domino Effect).

- Members delaying pursuit of new employment until after firm implosion are at a disadvantage

We certainly can not predict for sure when or even if Dewey LeBoeuf will implode, or shrink dramatically to firm recognizable only by name. And neither can its senior or junior members. However, we believe there can be no reasonable dispute to the observation that members who delay the pursuit of, or fail to obtain, a new position elsewhere would be at a severe disadvantage in the event of an actual dissolution of the firm.

These difficult economic times are exacerbated by aggressive corporate cost cutting methods, which are now being applied to a legal services industry with serious "over supply". A "falling tide" lowers all boats - and can seriously delay, or even prevent - the acquisition of a new job for the unemployed. In these times, the safety of maintaining the status quo is an illusion. Proactive career management may be the only risk averse strategy today, as far as continuous employment is considered.

As this concept is similar to the "Rush for Lifeboats" effect, we see a similar contribution to the "Snowball Effect". In the nomenclature as used in graduate studies of Systems Dynamics, as well as entry level electronic signals courses, this type of self reinforcing force is called a Positive Feedback Loop. An example we have all likely witnessed with audio systems is that loud and annoying squeal heard when a microphone is held too close to a loudspeaker system. Though not to be confused with the squeals one could expect during Dewey LeBoeuf's anticipated implosion.

- BigLaw Firm Status - Two Edged Sword

- High Fixed Costs

... More Coming Soon!

Shall we put it this way: "The Cat Is On The Roof"

Like the old joke about the traveler preferring to learn of the demise of his pet in small pieces over time, the unraveling of this brief amalgamation of lawyers seems a futile attempt in denial. We believe that the events we are witnessing at Dewey LeBoeuf are merely a prolonged dénouement to a self induced implosion which began at least a year ago. And that "the point of no return" was passed in conjunction with management's "decision" on the $155 Million dollar "accounting something".

BankruptcyMisconduct believes that the question of viability is being answered by the departing partners themselves. While we have best wishes for the majority of its members, and in particular its support staff and creditors, we believe that the ethical cloud around the firm suggests the firm's demise as a silver lining.

|

CA Bar Complaint (14930)

CA Bar Complaint (14930) SONICblue - A Claims Trader's Fees Reimbursed for Alerting about Attorney Misconduct (12892)

SONICblue - A Claims Trader's Fees Reimbursed for Alerting about Attorney Misconduct (12892) Haas v. Romney 2nd Amended Complaint (12206)

Haas v. Romney 2nd Amended Complaint (12206) CA Bar **Revised** Complaint (11363)

CA Bar **Revised** Complaint (11363) SEC filings by client of PriceWaterhouseCoopers and HBD (11093)

SEC filings by client of PriceWaterhouseCoopers and HBD (11093) Doug Pick Esq. advice on Death Threats (10960)

Doug Pick Esq. advice on Death Threats (10960) Judicial Complaint against Judge Paul G. Hyman by Mary Alice Gwynn (10662)

Judicial Complaint against Judge Paul G. Hyman by Mary Alice Gwynn (10662) Shock! Peck's Lehman case colored by fraud? (10361)

Shock! Peck's Lehman case colored by fraud? (10361) SEC - so simple even a Caveman can see it! (9911)

SEC - so simple even a Caveman can see it! (9911) CABAURHBDreq1 (9659)

CABAURHBDreq1 (9659)