***New Item: BankruptcyMisconduct proven prophetic as our Viability analysis of Intra Firm Risk specifically detailed "Informant Inclination". The Criminal investigation by the Manhattan District Attorney of Steven Davis was triggered by informartion from a number of partners of the law firm. Furthermore, as described in our ex post Dewey page, we believe that the General American Mutual conduct led to an ill conceived attempt to cover-up the misconduct with hush money. We believe that the criminal and ethical proceedings have likely Only Just Begun.

New Item: Banks File Lien

Those banks we were talking about ... they did it. Oh yes they did. Anybody who "lends" money to Dewey now (after the banks) is assured of getting zero. Translation: "If any of the lawyers at Dewey LeBoeuf held the sense of honor like Samuri, they'd be cleaning their tantō now."

How could Dewey LeBoeuf possibly survive at this point?

It's April 2012 and the firm desperately needs to prove to three groups that it deserves their support to continue as a going concern: Banks, Partners, & Clients. Because if any of these three fail to gamble their money on Dewey's hopes, then the firm's implosion will be a foregone conclusion.

1. The Banks

***New Item: Leaked News reports claim that the Banks are "close to a deal" to extend the credit line for as much as 90 to 120 days, in accordance with the Banks' term sheet. BankruptcyMisconduct has not seen this "term sheet" but we'll bet a sushi lunch that the phrase "personal guarantee" is prominent. "Loyalty" of the remaining partners notwithstanding, we just don't see these guys pledging their Co-op and Summer homes. We can't imagine the banks demanding anything less. We believe our analysis on this page is still appropriate. It is not unheard of for a bank to continue to extend financing in a pre-petition circumstance where the operation of the entity is clearly focused on improving the lenders' position, such as collecting receivables. Attention associates, don't expect the "delayed" Spring bonus check this May.

Time for a reality check folks. Banks are foreclosing on the homes of American citizens like no other time in history. The same banking industry that is afloat because they were bailed out with taxpayers' TARP funds. Does anyone believe that there is a single bank in America that wants to be featured, in an election year, as having risked money to bail out a law firm? A law firm where the most junior lawyers are making $500,000 per year and the big dogs ten times that and higher? Of course not. And BankruptcyMisconduct can guarantee that if the banks double down, the media will talk about it. We don't think that any bank will want to stand as a soldier with whatever currently remains of the law firm, even if extending the revolver would work, even if they genuinely believed the firm had a chance at survival.

BankruptcyMisconduct has seen banks pull their credit lines from firms suffering a fraction of the problems that Dewey LeBoeuf is now experiencing. The combination of problems compounds each issue. We can't imagine a loan officer risking her own job, in this economy, on the flimsy chance that these guys could survive. And that's even assuming that the decision maker was married to the "Chairman in exile". We've got publicly disclosed problems with revenue restatements, problems collecting receivables, "under-water" employment contracts, and a firm whose only genuine asset is talent pool which is shrinking.

New Item: Dan DiPietro of Citibank Hitches Career to Dewey LeBoeuf

BankruptcyMisconduct has just learned that Citibank, Wells Fargo, and perhaps Barclays are among the banks with a credit line to Dewey LeBoeuf. According to TheLawyer.com, Citibank is calling a hard line on Dewey's attempt to renegotiate the bank debt, a task which is far from certain. Dan DiPietro has publicly identified himself as the Citibank employee who believes Dewey LeBoeuf is in "good standing", so let's hope his kids have already finished college.

Many established media publications have reported about the lending covenants that commonly burden law firms who borrow from banks, as well as through debt securities. In an ad hominem attack on unnamed persons, Steven Davis slammed "internet blogs" as having "some other agenda going on that is trying to say inappropriate things" - ostensibly for having the temerity to engage independent thought. In particular, the Firm Whisperer exorbitantly protested those who questioned the issue of lending covenants by transmogrification into false rumor: "Those rumors are utterly and completely bogus". OK Steven, BankruptcyMisconduct is sorry that we got your panties all bunched up.

So let's change tacks and assume al arguendo that there hadn't been any lending covenants in the past. If such was true, then the lending officers who wrote such loans are now wiping their brows as the credit line comes up for renewal. Fool them once, shame on you. But you can't fool them twice after you publicly brag to CNN Fortune about your firm's financial flexibility in the face of these lending officer's failings in fundamental fiduciary duty to their employers. The best Dewey could hope for going forward would be an extremely strict set of covenants covering all manner of things from specification of number of partners, specific partners, receivables collection and aging metrics, adequate insurance coverage, adverse litigation exposure, and ethics proceeding status - climaxing in everybody's favorites: personal guarantees and subordination of partner distributions.

Yeah, the bank is going to want to be paid before the partners. If Dewey LeBoeuf thinks it has been hard holding onto rain making partners now, imagine the effect of demanded personal guarantees, and distributions delayed indefinitely beyond the horizon. For how many years will partners be expected to sacrifice while the banks, and then the bondholders, are paid off?

Yeah, instead of just listing "The Banks" perhaps we should have said "The Lenders" in recognition of whoever bought those private placement debt securities. Our thinking was that the bonds don't start maturing until next year, and we believe that the final song of the Dewey LeBoeuf tragedy will have been sung well before then. We expect "The Banks" to have pulled the plug well before "The bondholders" get their chance.

We could be wrong (though we really doubt it), but we believe that the firm will fail in its efforts to renew or restructure their line of credit with their banks. And even if Dewey is able to negotiate some sort of extension, we believe the terms the banks are forced to demand would result in untenable economics for remaining rainmakers. And so ... Reality begs the question: What is Jeffrey L. Kessler smoking these days:

“I will say we don’t feel we have any problem with the banks. It’s a routine renewal of a line of credit.”

2. The Partners

The firm will only survive if enough lawyers stay with the firm to produce revenues sufficient to fund all of their significant expenses and longer term liabilities.

Sadly, "Self Selection Bias" isn't working in the firm's favor. Not all partners are created equal, as we're sure Mr. Davis would admit. The best and the brightest group leaders and senior partners, who had been subsidizing the firm's ill-timed guarantees to newly hired "stars", have been most incentivized to defect. This hurts the firm on both the Revenue and Expense side of the cash flow equation. Even among the analysts who believe that the remaining partners may be enough for a chance at survival, there is a belief that a few more defections could be fatal.

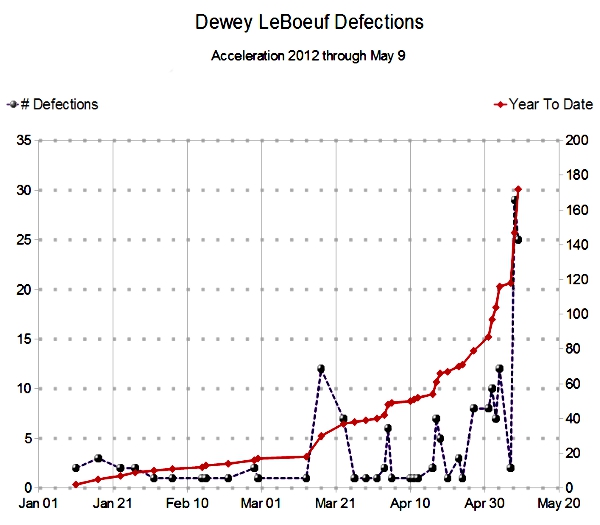

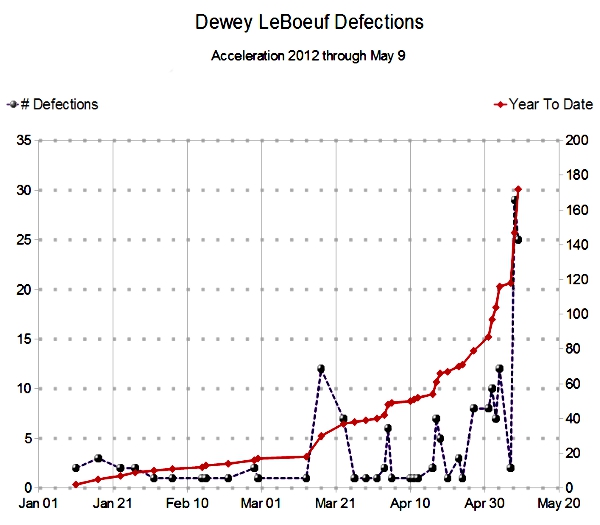

Let's try to analyze the firm's losses so far this year, in comparison to the senior/equity partners of the firm. We are not sure which of the "190 Senior partner" or "300 partner" figures we've read about elsewhere would be most appropriate to judge the severity of the approximate 50 partner loss so far this year. We believe some of the best group leaders, and groups have left. But even just taking the partner defection totals at an unweighted face value, the loss of 50 partners against either figure represents a shockingly damaging loss. This would be true for a firm which had been stable. However, Dewey LeBoeuf has recently admitted to having cash flow problems, let alone profitability. Public reports include that distributions to many partners have been defered for quite some time, and new multi-year hold-backs have been planned. These partner defections are like an already bleeding swordsman suffering new deep bleeding wounds. Survival is not what comes to mind.

Update: We started writing this page when partner defections where in the 40s, and published it at about 50. Now we see that partner losses have almost reached 100 as of May 3. We apologize for having been so optimisticly naive about the prospects of this firm. Our only defense is that the cunning prowess of that talented Michael Sitrick must have taken control of our feeble mind.

BankruptcyMisconduct, and all of the other pundits in the media, are merely outsiders reporting, commenting and editorializing on this unfolding story. The continuing defections of the partners themselves is the clearest signal possible on the firm's future. If insiders are bailing, it's not hard to accept that the end has already begun.

3. The Clients

The Banks or the Partners themselves are each sufficient destabilizing factors to cause the Dewey LeBoeuf stool to topple. You've got to ask yourself why BankruptcyMisconduct is wrote the rest of this page. We'll ignore for the moment the financial cash flow issue - as we don't even think the firm will have enough cash to make good on their delayed associate bonus payments. Clients may be a positive for the law firm. They represent the one variable which could determine how long Dewey LeBoeuf continues to survive.

Clients bring the revenues. And certain client matters will continue for some period of time. We don't know what the firm's "matter backlog" looks like. Perhaps there is enough there to keep them operating a number of months. BankruptcyMisconduct has a very difficult time imagining that new matters will be brought to the firm by clients. Big legal matters a serious for business, and who want's to jeopardize their job by signing with a firm whose ongoing existing is so commonly questioned? As at least one internet blog pointed out, there may be some matter where a client wouldn't go anywhere else than a particular Dewey partner. And that partner may still be at the firm. But our estimation is that new business will start to dry up for the firm.

We believe that a run on the firm, by it's partners, has already damaged the firm's reputation enough that new client matters won't be sufficient for the firm's continued existence. Even if the remaining partners have strong ties to their valuable clients, we don't see new matters being entrusted to the firm as had been in the past. We believe that Clients at best can only slow the demise of the firm.

So, Who You Gonna Call?

Of all of the mistakes that Dewey LeBoeuf has made in managing their recent troubles... We find nothing more pathetic than hiring Michael Sitrick as their public relations tool. You know that you've hit bottom when you hire the same PR dirtbag as Michael Vick - the NFL quarterback with the dog fighting ring on the side, Kobe Bryant - the basketball player with the hotel employee rape allegations, pedophilia operations of the Catholic Church, Chris Brown who beat up and later threatened his girlfriend Rihanna, as well as rumored Mensa member Paris Hilton. To be sure, it's not just failing persons that Sitrick represents, he also specializes in failing business, even bragging about more than 300 bankruptcy cases on their website.

What's ironic is that Sitrick's own firm is reportedly currently having problems including defections, not to mention that former employees of his believe they are getting screwed by dirty tricks. Hmm... Maybe Sitrick is the perfect match?

Dewey has done one thing right in this crisis of theirs. They chose a partner with great bankruptcy experience and untarnished ethics record, Martin J. Bienenstock, as part of their "gang of four" helping Steven H. Davis. Marty's bankruptcy experience may be of direct help to the firm's inner management circle fairly soon.

Seeking Viability, yes and urgently so. Finding it? Not even close.

|

CA Bar Complaint (14930)

CA Bar Complaint (14930) SONICblue - A Claims Trader's Fees Reimbursed for Alerting about Attorney Misconduct (12892)

SONICblue - A Claims Trader's Fees Reimbursed for Alerting about Attorney Misconduct (12892) Haas v. Romney 2nd Amended Complaint (12206)

Haas v. Romney 2nd Amended Complaint (12206) CA Bar **Revised** Complaint (11363)

CA Bar **Revised** Complaint (11363) SEC filings by client of PriceWaterhouseCoopers and HBD (11093)

SEC filings by client of PriceWaterhouseCoopers and HBD (11093) Doug Pick Esq. advice on Death Threats (10960)

Doug Pick Esq. advice on Death Threats (10960) Judicial Complaint against Judge Paul G. Hyman by Mary Alice Gwynn (10662)

Judicial Complaint against Judge Paul G. Hyman by Mary Alice Gwynn (10662) Shock! Peck's Lehman case colored by fraud? (10361)

Shock! Peck's Lehman case colored by fraud? (10361) SEC - so simple even a Caveman can see it! (9909)

SEC - so simple even a Caveman can see it! (9909) CABAURHBDreq1 (9658)

CABAURHBDreq1 (9658)