|

BankruptcyMisconduct.comhas been directing the public's attention to peculiar circumstances in a number of bankruptcy cases. These cases are exemplary in their demonstration of the need for a closer scrutiny by the media, the business community, and of course the Justice Department. These cases include:

- Syntax-Brillian USBC Delaware 08-11407-BLS The SEC has blinders on, is it because the lawyers their are wed both figuratively and literally into the web of dirty lawyers who are involved in the financial frauds enriching the criminals around us? When will Fraud Upon The Court be properly addressed, when will the criminals be defeated?

- City of Detroit USBC Eastern District of Michigan (Detroit). 13-bk-53846 Detroit will have much to teach us, but it is still too early to know exactly what we will learn. Will dirty lawyers at Jones Day really disprove the idiom that "Crime Doesn't Pays" and will Bill Schuette follow through with his promise?

- Texas Rangers Baseball Partners USBC Northern District of Texas, Fort Worth. No. 10-43400-dml11 Let's be honest about something, everyone "in the business" who's taken a gander at BankruptcyMisconduct has cocked a brow at the quite low profile of Weil Gotshal & Manges, particularly when the conflict of interest issue seems such a fixation to this site's contributors. Well dear readers, contributors, and fellow victims - we proudly present our initiation of coverage on yet another exemplary case. Click the Texas Rangers name above to go to our introductory page, or click here to see our downloads. And a special thanks to the special person who brought this case to our attention.

Â

- ONDOVA LIMITED COMPANY / Jeffrey Baron USBC Northern District of Texas, Dallas. No. 09-34784-SGJ-11

- USDC Northern District of Texas, Dallas Division No. 3:13-CV-3461-L

BankruptcyMisconduct is just watching these cases. Here is our main source of info, and we'll host copies of some of the juicy docs on our downloads site.

Looks like Judge Hyman in Florida has an inbred relative on the bench in Texas. But we're just saying... Stay tuned!

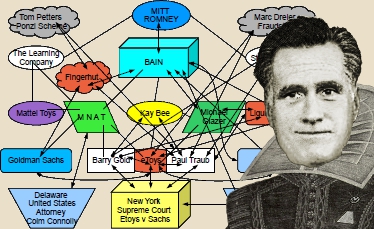

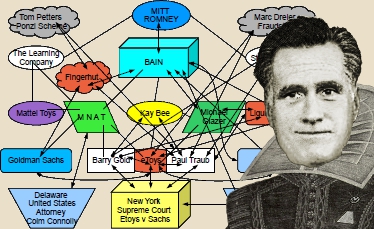

Mitt Romney and his hedge fund Bain Capital have done the same dance over and over. Problem is, their dance partners are often the same "bankruptcy professionals" and we believe that it is only a matter of time before someone connects the conflict of interest related to these bankruptcy cases: Mitt Romney and his hedge fund Bain Capital have done the same dance over and over. Problem is, their dance partners are often the same "bankruptcy professionals" and we believe that it is only a matter of time before someone connects the conflict of interest related to these bankruptcy cases:

- Stage Stores USBC Southern District of Texas case No. 00-35078

- Bonus Stores, Inc. USBC District Of Delaware case No. 02-12284 (MFW) Walrath

- KB Toys, Inc., et al. USBC District Of Delaware lead case No. 04-10120 (DDS)

- F. A. O. Schwarz

- eToys USBC District Of Delaware lead case Nos. 01-706 through 01-709

Â

- MF Global Holdings Ltd., et al. USBC Southern District of New York lead case No. 11-15059 (MG). Judge Stuart M. Bernstein handed over this hot potato to Judge Martin Glenn like a hooker flinging a spent condom at her Jon as the vice squad breaks through the door. Speaking of ... Jon Corzine is the filthy rich teflon neo-Don involved in all sorts of dirt and dirty politics. Former CEO of Goldman Sachs, Governor of New Jersey, and most recently in charge of MF Global. Well, it seems that MF Global was co-mingling client funds, which is a fancy word for 'stealing client money'. Too harsh? How about "borrowing client money without asking until we get caught and it's all gone". Doesn't matter, when you have a guy with the balls to purchase the governorship of New Jersey while forming mutual non-aggression pacts with NJ's massive organized crime syndicates, you can bet your bottom dollar that this bankruptcy case will be handled by some of the most skillful cover-up artists in the business. The rampant crime in Corzine's MF Global will be buried faster and deeper than a boy scout's soiled shorts on a hot Summer Jamboree.

- Solyndra LLC, et al. USBC District of Delaware No. 11-12799 (MFW) Walrath. The new green dream darling of President Obama files for Chapter 11, but not until after getting over half a BILLION dollars in government backing for loans. This means that the hedge funds who actually made the loans will get their half billion of money back and instead taxpayers will suffer the loss. No Bankruptcy Misconduct here, move along please.

- Washington Mutual et al. ( also known as WaMu ) USBC District of Delaware No. 08-1229 (MFW). So how does corruption effect the whole sale theft of a bank with the aid and support of Pelosi's bank bailouts, enriching certain connected hedge funds whilst defrauding common shareholders? Don't even think of saying 'quid pro quo', this is a family friendly web site.

- SONICblue, Inc. USBC Northern District of California (San Jose) No. 03-51775 (MM). Pillsbury Winthrop Shaw Pittman engages in professional misconduct and the presiding Judge, Marilyn Morgan, and government lawyers at the Office of the U.S. Trustee were duty bound (18USC section 3057) to report the Fraud Upon the Court.

- Graphics Properties Holdings, Inc., et al. USBC Southern District of New York No. 09-11701 (MG) They sometimes call it a "Chapter 22" when a reorganized company goes back into Chapter 11, but there is much more to the story of a great forerunner of computer imagery: Silicon Graphics. A creditor by the name of Eliot I. Bernstein, a self proclaimed inventor seems determined to ensure that conflict of interest and other Fraud Upon The Court does not allow lady justice to be pimped by dirty lawyers and public officials.

- Donna Sturman USBC Southern District of New York Case No. 02-11671 In re Donna A. Sturman presiding Judge, Prudence Beatty. Related bankruptcy cases also in SDNY include In re: Wayne A. Sturman 89 B 11932, Bruce D. Sturman 89 B 11933, Howard P. Sturman 89 B 11934. Take note of the downloads section devoted to this issue here.

- EAGLE BROADBAND, INC. et al. USBC Southern District of Texas Galveston Division No. 07-80605-G3-11. Another case of Fraud Upon The Court by an attorney seeking to be counsel for a Debtor. But in this outrageous case, neo-mafioso Jeff Adams, Esq. files a blatantly fraudulent affidavit in which he lied about not having been an officer to a number of the affiliated Debtors. We've got the order in our News & Notable download section.

Even before the case has closed, allegations of fraud on court have surfaced before a judge who himself belongs in prison for domestic violence.

- eToys Inc. et al. USBC Delaware, Nos. 01-706 etc. The embarrasingly corrupt eToys mega case arguably the clearest collection of blatant crimes by estate professional attorneys, such crimes dutifully covered up by DOJ lawyers whose supreme function as government officials was arranging their lucrative carriers in private practise. Degenerated public officials of the SEC and DOJ abuse their roles as public officials to trade prosecutorial discretion, obfuscation (a/k/a the cover-up), and honest services fraud to neo-mafia BigLaw firms for partnership positions in multi-million dollars jobs for themselves and their family members.

- SEC ignoring Madoff warnings in re: Aureal, Inc.; USBC Northern District of California, No. 00-42104 T11. Finally Public! This document was kept secret in deference to the SEC. Well, time's up. Bernie Madoff was not the only hedge fund crook filling false documents with the SEC. There were other scams employed by hedge funds right under the noses of the SEC besides a Ponzi Scheme like Bernie's.

How about when a hedge fund does a hostile takeover of a public company and takes all of the money for themselves while their conflicted lawyers oversee multiple fraudulent filings to the SEC?

Harry Markopoulos was not the only independent business person who took the risk of putting his own name on a letter to the SEC warning of crime by a hedge fund. This document is the follow-up, with color charts detailing obvious SEC violations, sent initially via eMail and later copied via certified letter to Linda Chatman Thomsen and her boss Christopher Cox, to the original letter requested by Marc J. Fagel regarding SEC filings by the client of PriceWaterhouseCoopers and HBD. Surely it is a sad notion, but please realize that spouses, nieces, and nephews of SEC lawyers count on corruption in order to land multi-million dollar roles as partners at BigLaw law firms, broker dealers, and hedge funds. These corrupt government lawyers view their job responsibilities and authority as a bargaining chip to riches:

"You want me to look the other way?"

"Send more $$$ business to my husband's law firm!" or "My niece needs to make partner!" or "If my cousin's wife is hired by your hedge fund I'll see that your fine will be a minor slap on the wrist". Yes, justice in America has been traded for favors by SEC and DOJ lawyers, and the of the spiral of unopposed fraud is what has caused our current financial crisis.

- James F. Walker USBC Southern District of Florida, No. 03-32158-PGH. An honest lawyer, Mary Alice Gwynn discovers fraud on the court by Gary J. Rotella, Esq. (now featured on his own page on this site here) as he acted as debtor's counsel to the convicted felon James F. Walker before the Honorable Paul G. Hyman, Jr. Mr. Rotella defrauded the court when he lied about having received a blatantly conflicting 50% ownership interest in the debtors sole disclosed asset: a Cat Cay Caribbean mansion in the Bahamas. But that's not all! A Court appointed "professional" for the creditors also lied: Keeping secret that he was the President of the very same exclusive Cat Cay millionaires' getaway - and was either working as a mole for the felon from the start or sabotagued the case in order to hide his own disclosure fraud as convict Walker's lawyer clearly obtained proof of the undisclosed conflict during specially crafted discovery which served no other purpose. The conduct of Judge Paul Hyman is dishonorable as he blatantly protects all of his brethren criminals: Judicial Complaint against Judge Hyman with exhibits list, Exhibits 1-9 thereto, and Exhibits 13-17 thereto - Lucky exhibit 13! is the complaint showing crime by Gary Rotella, Esq.

- Baron's Stores, Inc. USBC Southern District of Florida No. 97-25645 BKC-PGH. A forensic document specialist finds that the official plan filed by the Debtor's counsel was a fabrication. Read about it here in our documents section. Meryl Lanson is the Terminator against bankruptcy crime by sleezy lawyers, and she will never give up.

- The Leslie Fay Companies, et al. USBC Southern District of New York No. 93-B-41724(TLB). The Leslie Fay crimes involve the former Bear Stearns and the most powerful bankruptcy enterprise in the nation. High profile lawyers paid a million dollar slap on the wrist, a tiny fraction of their fully forfeitable fees, instead of being incarcerated for perjury like Little Kim from Dancing With The Stars. There is no question that the unlawful Court protection of dirty corporate executives and their lawyers in the Leslie Fay case set in motion the spiral of increasing corporate fraud which brought us Enron, WorldCom, Fannie Mae, and our current financial crisis.

Â

- The " Asbestos Ring " involves a number of U.S. federal bankruptcy court reorganization cases. These cases have in common: the State of Delaware, the use of asbestos litigation by injury lawfirms against large companies, astounding mega fees paid by the debtors to bankruptcy professionals, a locus of several bankruptcy industry firms, and most significantly the emerging evidence of a pattern of fraud by one or more bankruptcy professionals.

- CH II American Inn Inc. USBC (Oklahoma?) Bk-85-2221-A. Numerous possible conflict of interest, ACPOC Syndrome. Will a nation, whose freedom and prosperity would surely end but for the dedication and sacrifice of its armed forces, survive if the honor of its warriors and the Constitution for which they risked their lives to defend, are defamed and disrespected in its Courts by profiteering brethren of the bar?

- "Rick" USBC, Northern District of Illinois, Western Division, Case Number 99-50046, Judge Manuel Barbosa presiding. Issues related to the conduct of the private Trustee: Thomas Lester and his law firm Hinshaw & Culbertson, include a closed bankruptcy case reopened under peculiar justification, the forced sale of a house occupied by a single parent with two children for $138,389.59 in gross proceeds, less $112,557.87 for the cost of sale. Allegations include that a prior valid court order of payment to the divorced spouse was ignored, as well as the homestead exemption. Upon information and belief, a bankruptcy trustee or other professional is not entitled to having fees paid that did not or could have benefited the estate.

- John Deep USBC Northern Distric of New York, Nos. 02-11552, 02-11745, and 02-11755.

Mr. Deep is well known for his creation of Aimster, and was apparrantly represented by the renowned attorney David Boies, who in turn is reported to have earned fees representing clients including Microsoft, the presidential election dispute on behalf of Al Gore, and entities associated with the RIAA.

Incredible allegations of undisclosed conflict of interest, false affadavits, conspiracy, and more. Bogus order overturned on appeal. Watch this case, we will and we won't let its ultimate resolution be a quiet whisper.

- V&M Management, Inc. USBC District of Massachusetts (Eastern Division), No. 96-10123-CJK presided over by Judge Carol J. Kenner

- Stone & Webster, et al. USBC District of Delaware No. 00-2142 (PJW)

- Aureal, Inc., USBC Northern District of California No. 00-42104 (T)

|

CA Bar Complaint (14925)

CA Bar Complaint (14925) SONICblue - A Claims Trader's Fees Reimbursed for Alerting about Attorney Misconduct (12883)

SONICblue - A Claims Trader's Fees Reimbursed for Alerting about Attorney Misconduct (12883) Haas v. Romney 2nd Amended Complaint (12201)

Haas v. Romney 2nd Amended Complaint (12201) CA Bar **Revised** Complaint (11357)

CA Bar **Revised** Complaint (11357) SEC filings by client of PriceWaterhouseCoopers and HBD (11086)

SEC filings by client of PriceWaterhouseCoopers and HBD (11086) Doug Pick Esq. advice on Death Threats (10956)

Doug Pick Esq. advice on Death Threats (10956) Judicial Complaint against Judge Paul G. Hyman by Mary Alice Gwynn (10652)

Judicial Complaint against Judge Paul G. Hyman by Mary Alice Gwynn (10652) Shock! Peck's Lehman case colored by fraud? (10353)

Shock! Peck's Lehman case colored by fraud? (10353) SEC - so simple even a Caveman can see it! (9894)

SEC - so simple even a Caveman can see it! (9894) CABAURHBDreq1 (9649)

CABAURHBDreq1 (9649)

Mitt Romney and his hedge fund Bain Capital have done the same dance over and over. Problem is, their dance partners are often the same "bankruptcy professionals" and we believe that it is only a matter of time before someone connects the conflict of interest related to these bankruptcy cases:

Mitt Romney and his hedge fund Bain Capital have done the same dance over and over. Problem is, their dance partners are often the same "bankruptcy professionals" and we believe that it is only a matter of time before someone connects the conflict of interest related to these bankruptcy cases: